Truck Insurance In Dallas Tx Fundamentals Explained

Wiki Article

Indicators on Life Insurance In Dallas Tx You Need To Know

Table of ContentsLittle Known Facts About Home Insurance In Dallas Tx.The Definitive Guide for Insurance Agency In Dallas TxThe smart Trick of Health Insurance In Dallas Tx That Nobody is Talking AboutThe Buzz on Truck Insurance In Dallas TxGetting My Commercial Insurance In Dallas Tx To Work

The costs is the quantity you pay (usually monthly) in exchange for medical insurance. Cost-sharing refers to the portion of eligible medical care costs the insurance provider pays and also the portion you pay out-of-pocket. Your out-of-pocket expenses might consist of deductibles, coinsurance, copayments as well as the complete cost of healthcare services not covered by the strategy.This type of health insurance policy has a high insurance deductible that you have to fulfill prior to your wellness insurance policy coverage takes effect. These plans can be best for people who want to conserve money with reduced regular monthly premiums and don't plan to use their medical coverage thoroughly.

The downside to this kind of protection is that it does not meet the minimum important protection needed by the Affordable Care Act, so you may also undergo the tax obligation penalty. On top of that, temporary strategies can leave out insurance coverage for pre-existing problems (Insurance agency in Dallas TX). Short-term insurance coverage is non-renewable, as well as doesn't consist of protection for preventative care such as physicals, vaccines, oral, or vision.

Consult your very own tax, bookkeeping, or lawful advisor rather of depending on this article as tax, accountancy, or lawful recommendations.

Insurance Agency In Dallas Tx for Beginners

You must also detail any kind of person who occasionally drives your automobile. While the plan just needs you to provide "customary" drivers, insurance companies typically translate this term broadly, and also some require that you detail any individual who may use your lorry. Typically, motorists who have their very own vehicle insurance plan can be provided on your plan as "deferred operators" at no service charge.You can normally "omit" any kind of household member that does not drive your cars and truck, but in order to do so, you have to submit an "exclusion type" to your insurance policy firm. Chauffeurs that just have a Learner's License are not needed to be detailed on your policy till they are fully certified.

Not known Facts About Health Insurance In Dallas Tx

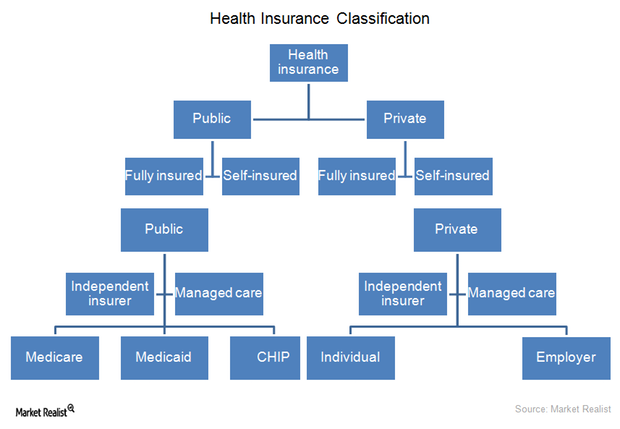

Plus, as your life adjustments (claim, you get a new task or have a baby) so should your insurance coverage. Listed below, we've explained briefly which insurance policy coverage you should highly consider buying at every phase of life. Note that while the plans below are arranged by age, naturally they aren't all set in rock.Here's a quick introduction of the policies official source you require and when you need them: The majority of Americans need insurance coverage to pay for healthcare. Picking the plan that's right for you may take some study, however it works as your first line of protection against medical financial debt, one of most significant resources of financial debt among consumers in the United States.

In 49 of the 50 US states, chauffeurs are called for to have vehicle insurance coverage to cover any kind of potential residential or commercial property damages and also bodily damage that may result from a mishap. Car insurance coverage prices are largely based on age, credit report, vehicle make read what he said as well as version, driving document and also location. Some states even take into consideration gender.

Special needs insurance coverage is indicated to supply earnings must you be handicapped as well as not able to function. If you're depending on a consistent income to support yourself or your family, you should have impairment insurance coverage.

Insurance Agency In Dallas Tx Things To Know Before You Buy

An insurance company will certainly consider your home's place, along with the size, age and build of the house to identify your insurance premium. Homes in wildfire-, twister- or hurricane-prone locations will almost always regulate greater costs. If you market your home and return to renting out, or make various other living arrangements.

For people who are aging or handicapped as well as need aid with everyday living, whether in an assisted living facility or via hospice, lasting treatment insurance can help carry the exorbitant costs. This is the type of thing people do not consider up until they obtain older and also understand this could be a truth for them, however naturally, as you obtain older you get extra expensive to insure.

Essentially, there are 2 kinds of life insurance policy intends - either term or irreversible strategies or some mix of both. Life insurance companies use different Home insurance in Dallas TX forms of term plans and conventional life policies along with "passion delicate" products which have actually become a lot more prevalent since the 1980's. Truck insurance in Dallas TX.

Term insurance offers security for a given time period - Commercial insurance in Dallas TX. This duration might be as short as one year or offer coverage for a specific variety of years such as 5, 10, twenty years or to a defined age such as 80 or in some instances as much as the earliest age in the life insurance policy mortality tables.

10 Easy Facts About Health Insurance In Dallas Tx Described

Report this wiki page