An Unbiased View of Wealth Management

Wiki Article

Wealth Management Things To Know Before You Buy

Table of Contents8 Easy Facts About Wealth Management DescribedGetting The Wealth Management To WorkThe smart Trick of Wealth Management That Nobody is Talking AboutA Biased View of Wealth Management7 Simple Techniques For Wealth Management

You wish to ensure that your family might make it through monetarily without drawing from retirement cost savings should something take place to you. As you age, your investment accounts must come to be a lot more conventional - wealth management. While time is running out to conserve for people at this stage of retirement preparation, there are a few benefits.And it's never ever also late to set up and contribute to a 401( k) or an Individual retirement account. One benefit of this retired life planning phase is catch-up payments.

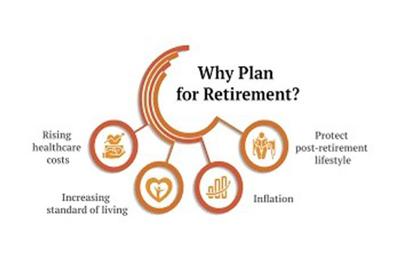

This is additionally the moment to explore long-lasting treatment insurance, which will help cover the prices of an assisted living home or house care should you require it in your innovative years. If you do not correctly prepare for health-related expenses, particularly unexpected ones, they can decimate your financial savings. The Social Security Management (SSA) uses an online calculator.

Wealth Management Can Be Fun For Anyone

It takes right into account your full economic image. How does that fit right into your retirement plan?

There might additionally be changes boiling down the pipe in Congress regarding inheritance tax, as the estate tax quantity is set up to go down to $5 million in 2026. When you reach old age as well as begin taking distributions, taxes come to be a big problem. The majority of your retired life accounts are strained as regular income tax obligation.

Top Guidelines Of Wealth Management

Age comes with raised clinical expenditures, as well as you will have to browse the often-complicated Medicare system. Lots of people really feel that conventional Medicare does not provide adequate protection, so they aim to a Medicare Advantage or Medigap plan to supplement it. There's also life insurance coverage and lasting care insurance coverage to take into consideration. One more kind of plan provided by an insurance policy firm is an annuity.

You put cash on down payment with an insurance policy business that later on pays you a set month-to-month quantity. There are various alternatives with annuities as well as lots of factors to my latest blog post consider when making a decision if an annuity is right for you. Retirement preparation isn't tough. It's as simple as establishing aside some cash every monthevery little counts.

You might additionally desire to consider speaking with an expert, such as a monetary organizer or financial investment broker that can steer you in the ideal direction. The earlier you start, the much better. That's since your investments expand over time by making interest. As well as you'll earn interest on that particular rate of interest. Retirement planning permits you to sock away adequate cash to preserve the exact same way of living you presently have.

That's where retired life planning comes into play. And it does not matter at which point you are in your life.

Wealth Management Fundamentals Explained

We have produced a detailed overview that can aid you plan your retirement. Many investment choices can help you conserve for retired life. We comprehend that growing your money securely is crucial.When investing your money, make sure that you conserve sufficiently for any unforeseen monetary demands. Life insurance coverage can safeguard your liked ones with a protective financial safety and security in your absence.

When planning for the future, attempt to select different sorts of investment alternatives that put your money in differing possession courses, markets, and also sectors. This means, if you suffer a loss in one investment or if one option does not do per your expectations, you can count on the others.

If you wish to work out in a brand-new city, your regular monthly expenses might be greater, depending on the city. Similarly, if you like to take a trip, you might spend extra on Clicking Here travel costs in retired life than a person that favors going to residence. Your desires can help you choose a suitable plan that can create enough returns.

Fascination About Wealth Management

These can differ depending on the plan you pick. Retired life plans generally allow you to select the site link premiums you intend to pay towards your strategy, according to your needs. A higher costs might bring about a greater income during your retirement. The vesting age is the age at which you can start obtaining your pension or earnings from the plan.Report this wiki page